On January 30, 2020, the Securities and Exchange Commission (SEC) issued a proposed rule, Management’s Discussion and Analysis, Selected Financial Data, and Supplementary Financial Information. The proposed rule is a part of the SEC’s disclosure effectiveness initiative and would eliminate certain disclosure requirements and enhance management’s discussion and analysis (MD&A).

Comments on the proposed rule are due within 60 days of publication in the Federal Register.

Key Provisions

In December 2013, the SEC issued a staff report, Report on Review of Disclosure Requirements in Regulation S-K, as mandated by the Jumpstart Our Business Startups Act (JOBS Act). Based on a recommendation in this report, the SEC staff initiated an evaluation of disclosure requirements to assess the information required, how and where the information is presented, and how technology can be better leveraged in an effort to improve the disclosure requirements for both investors and registrants. In connection with this study, the SEC staff also received public input on how to improve registrant disclosures.

As a result of the evaluation and public outreach, the SEC is proposing certain amendments to Regulation S-K to simplify compliance efforts for registrants and focus the disclosure requirements on material, relevant information. Specifically, the proposed rule would eliminate disclosure requirements in Item 301, Selected Financial Data, and Item 302, Supplementary Financial Information, and enhance the disclosure requirements in Item 303, MD&A. Here are the key provisions.

Item 301, Selected Financial Data

Item 301 requires registrants to provide selected financial data in a comparative table for the last five fiscal years in registration statements and annual reports on Form 10-K. The SEC staff determined that the information required by Item 301 can be readily accessed and compiled through prior filings on EDGAR. As a result, the proposed rule would eliminate Item 301 and registrants would no longer be required to provide five years of selected financial data.

Item 302, Supplementary Financial Information

Item 302(a) requires disclosure of selected quarterly financial data for each quarter in the last two years. As the information required by Item 302(a) is repetitive and can also be found in prior quarterly filings or can be calculated for the fourth quarter from registrants Form 10-K and third quarter Form 10-Q, the proposed rule would no longer require registrants to provide two years of selected quarterly financial data.

Item 303, Management’s Discussion and Analysis

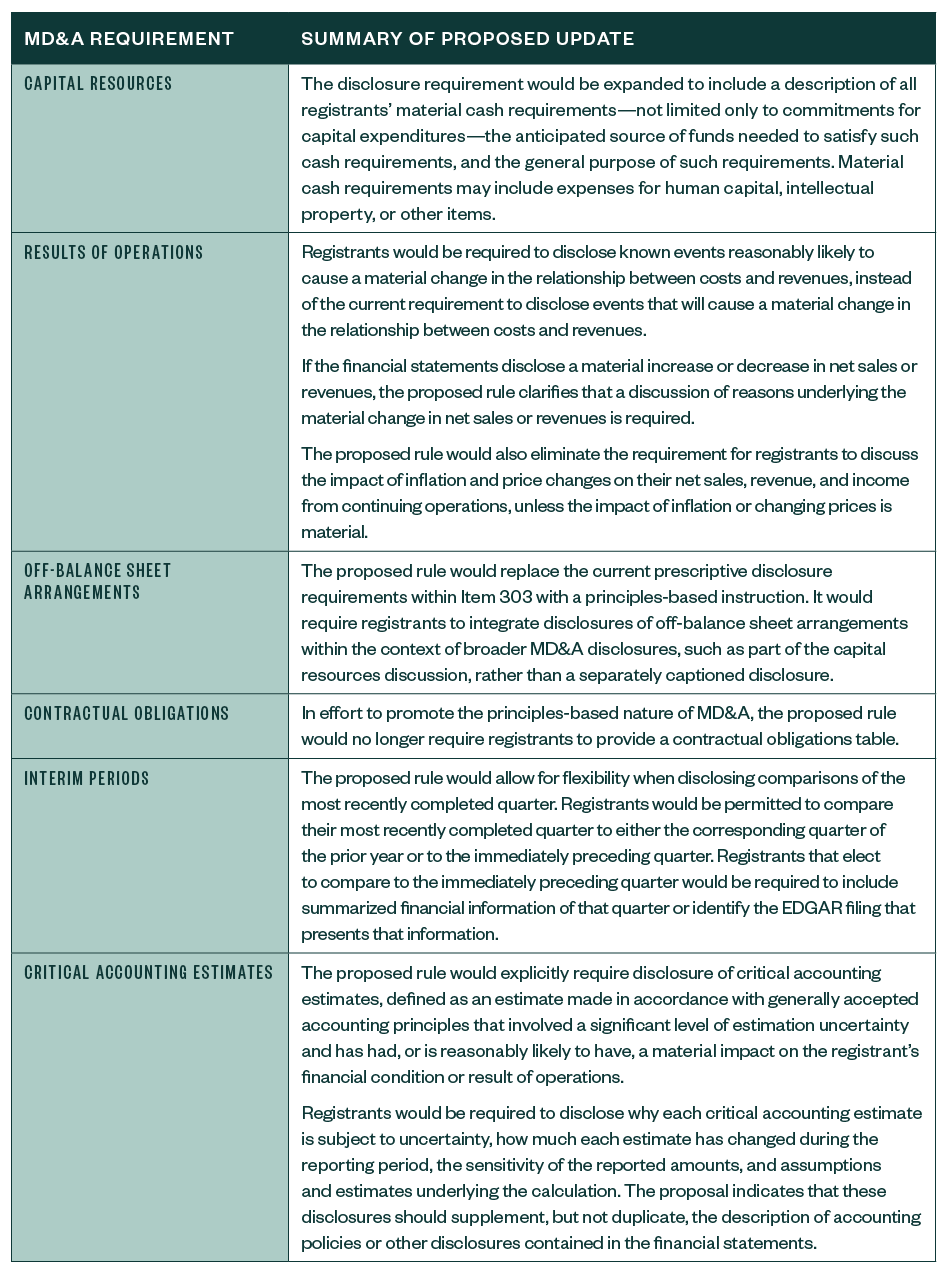

Item 303 requires disclosure of information relevant to assessing a registrant’s financial condition, changes in financial condition, and results of operations. The proposed rule would update instructions for Item 303 and clarify that when there are material changes in a line item, both quantitative and qualitative disclosure of the underlying reasons for those material changes is required. The proposed rule would further improve and simplify the content and objective of MD&A as follows:

We're Here to Help

For more information on how the proposed changes to financial disclosure requirements in Regulation S-K could affect your business, contact your Moss Adams professional.